CEO Pay in Hospitality 2025

In last year’s study of CEO pay, we explored the ongoing shifts in compensation following the pandemic’s disruptive impact on the hospitality industry. This year, we turn our focus to a period defined by mounting global uncertainty, driven by political transitions, tariffs and worldwide trade deals. Amid this backdrop, reassessing CEO compensation and corresponding performance metrics has been critical.

Despite economic volatility, CEO pay across the hotel sector continued a steady upward climb. In our current study, the average CEO compensation package escalated from $9.8M to $11.9M year over year. Unlike the previous year, when most gains came from short-term incentives, this year’s increases were driven by long-term incentives, making up the bulk of the $2M difference. While “other compensation” trended downward from previous years, base salaries rose by just over USD $100K, and short-term incentives remained largely unchanged. It looks like public boards are de-emphasizing perquisites and focusing more on variable pay.

In contrast, according to the AHLA and Hotel Dive, the average annual salary in the U.S. hospitality industry rose 2.6% to just under $58,000 – nominal gains for a third year in a row. Because of this salary stagnation, the CEO-to-average pay ratio widened, expanding from 146:1 in 2022 to 205:1 in 2024. It’s interesting to see pay for line level employees pushing up through collective bargaining and minimum wage initiatives, yet it appears positions in middle management may be stagnating.

Financially, the companies in our peer group demonstrated solid growth. Average market capitalization climbed to over USD $24B, up from $17B last year, while average EBITDA grew to $2B, compared to $922M in 2022.

Note: Financial Data sourced from SEC filings/Proxy Statements.

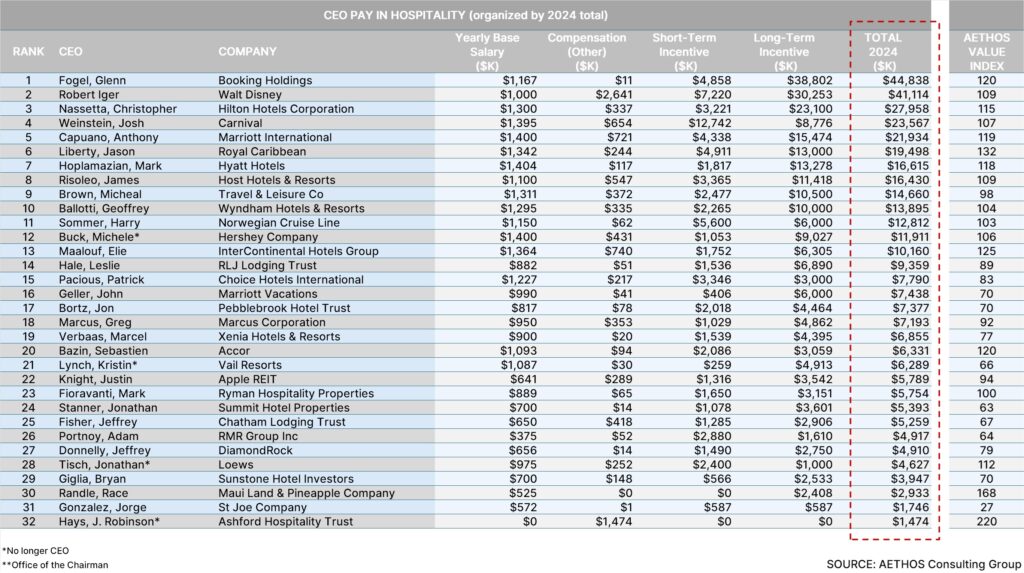

Among the peer group CEOs, Glenn Fogel of Booking Holdings continues to lead the pack with USD $44.8 million in total compensation. The cruise sector rebounded significantly from previous years, which was reflected in CEO compensation. Josh Weinstein of Carnival received the largest bonus in the peer group at USD $12.7 million, while Jason Liberty at Royal Caribbean received a $13M stock grant. The largest salary in the group of approximately $1.4M was shared by four CEOs, Mark Hoplamazian of Hyatt, Anthony Capuano at Marriott, Michele Buck at Hershey and Elie Malouf at IHG. Nine CEOs had stock grants that totaled in the tens of millions with Fogel, Bob Iger at Disney, and Chris Nassetta at Hilton leading the way.

A key element of the AETHOS Value Index methodology is quantifying the degree to which a CEO is over- or under-paid. This Index compares total compensation to performance metrics such as growth in EBITDA, stock price, and market cap; essentially determining “fair pay”.

With an AETHOS Value Index (AVI) score of 220, Rob Hays of Ashford Hospitality Trust was the most underpaid CEO in the group. Race Randle of Maui Land & Pineapple Company followed with an AVI score of 168, while Jason Liberty earned a score of 132. Jorge Gonzalez of The St. Joe Company recorded the lowest AVI at 27, indicating he was overpaid by nearly 73% relative to his CEO peer group.

Although the fundamentals in the hospitality industry remain strong, economic headwinds are starting to emerge. The impact of tariffs, international travel and massive government layoffs are factors worth noting. Furthermore, transaction levels in the hotel sector have dramatically decreased over the past 18+ months, putting a lid on asset valuations and market cap appreciation. As the economic dust settles on 2025 next month, it will be interesting to see which players come out ahead – will asset-light operators or real estate-heavy companies take the prize?