Covid Uncertainty Does Not Discourage European Hoteliers

Sentiment Remains Fragile, But Silver Linings Are In Sight

As the UK prepares for reopening the hospitality industry, Aethos™ sought to get a clearer picture of the sentiment amongst branded as well as independent hotel operators. The idea – to contrast the mood of the British hospitality industry with that of a country where hoteliers have already had a little ‘head start’ due to the earlier lifting of restrictions.

Two Steps Forward, One Step Back

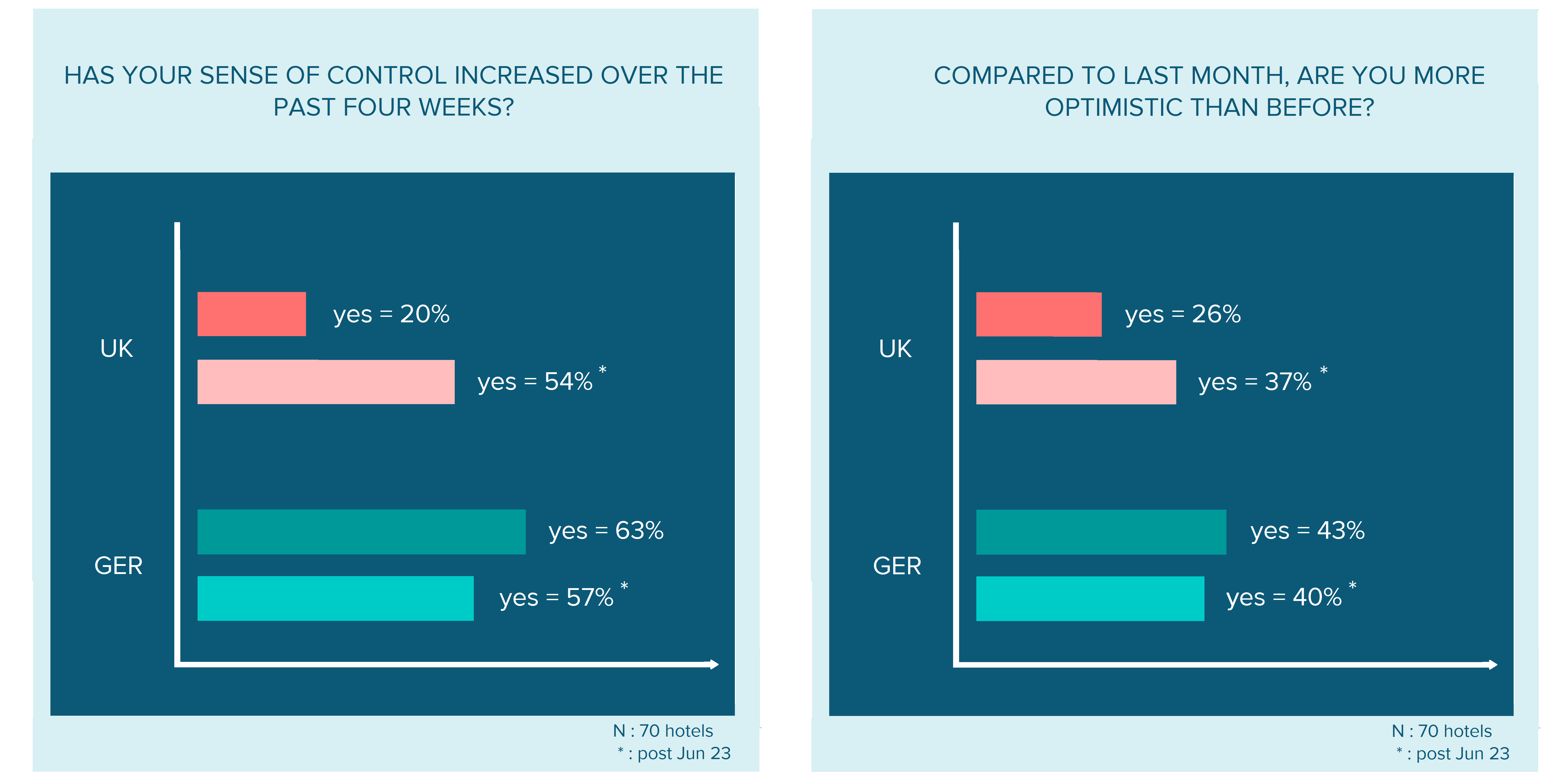

Unsurprisingly, with UK hospitality businesses still in lock down at the time of writing, operators felt little sense of control of the situation at hand. Unclear policies and regulations, and questions around the timing of the reopening of the industry, severely damped business leaders’ mood. In contrast, in Germany, where many hotels had already reopened during the month of May, the first few weeks of operations seem to have heightened executives’ sense of control – they have been able to test safety rules and measures, and staff and guests alike have slowly gotten familiar with the mitigating factors. The group was re-approached post June 23rd – the day on which the British government set a clear date for the industry to reopen and on which the mood in the UK significantly improved. Yet, the German hoteliers – who had learned a couple of days earlier from a resurgence of cases in a meat processing plant and renewed, although locally restricted, lockdowns – have gotten slightly more ‘jittery’. This is evidence that the situation remains rather fluid and fragile. In fact, commentaries from the survey group include numerous references to the many uncertainties that remain. For example, hoteliers from both countries lamented that business on the books remains very low – and with most large-scale events continuing to be postponed or cancelled, and many of the demand driving attractions being shut (such as most theatre and entertainment businesses), difficulty of preparing for the next few months ahead remains high.

Nonetheless, and although daunted by the huge task at hand to reopen businesses, UK hoteliers seemed relieved to be able to ‘get going’, with at least some sense of renewed optimism being observed amongst the survey group. Many commented on the expected high levels of pent-up demand and a summer defined by ‘staycations’. The easing of travel restrictions and the suggested ‘air bridges’ (or so-called ‘tourism bubbles’) between countries with comparatively low infection rates are expected to further bolster demand. The news that one of the well-known UK hotel brands (Travelodge) managed to secure temporary rent payment cuts through to December of 2021, and that the government would extend the moratorium on lease forfeitures, also plaid a role in British hoteliers’ sense of relief. In contrast, German hoteliers’ optimism appears to have slightly muted in the recent past – although business had picked up (with resort hotels in particular reporting solid demand), the excitement of re-opening seems to have given way to the stresses of managing operations in a difficult environment defined by profit-limiting ‘performance plateaus’ and unpredictable, and much shorted, booking patterns. However, participants commented positively, for example, on the support received through reductions in VAT on lodging, food and drink (something for which their UK counterparts are also hoping for) as well as the trial ‘air bridge’ between Germany and Mallorca / Spain.

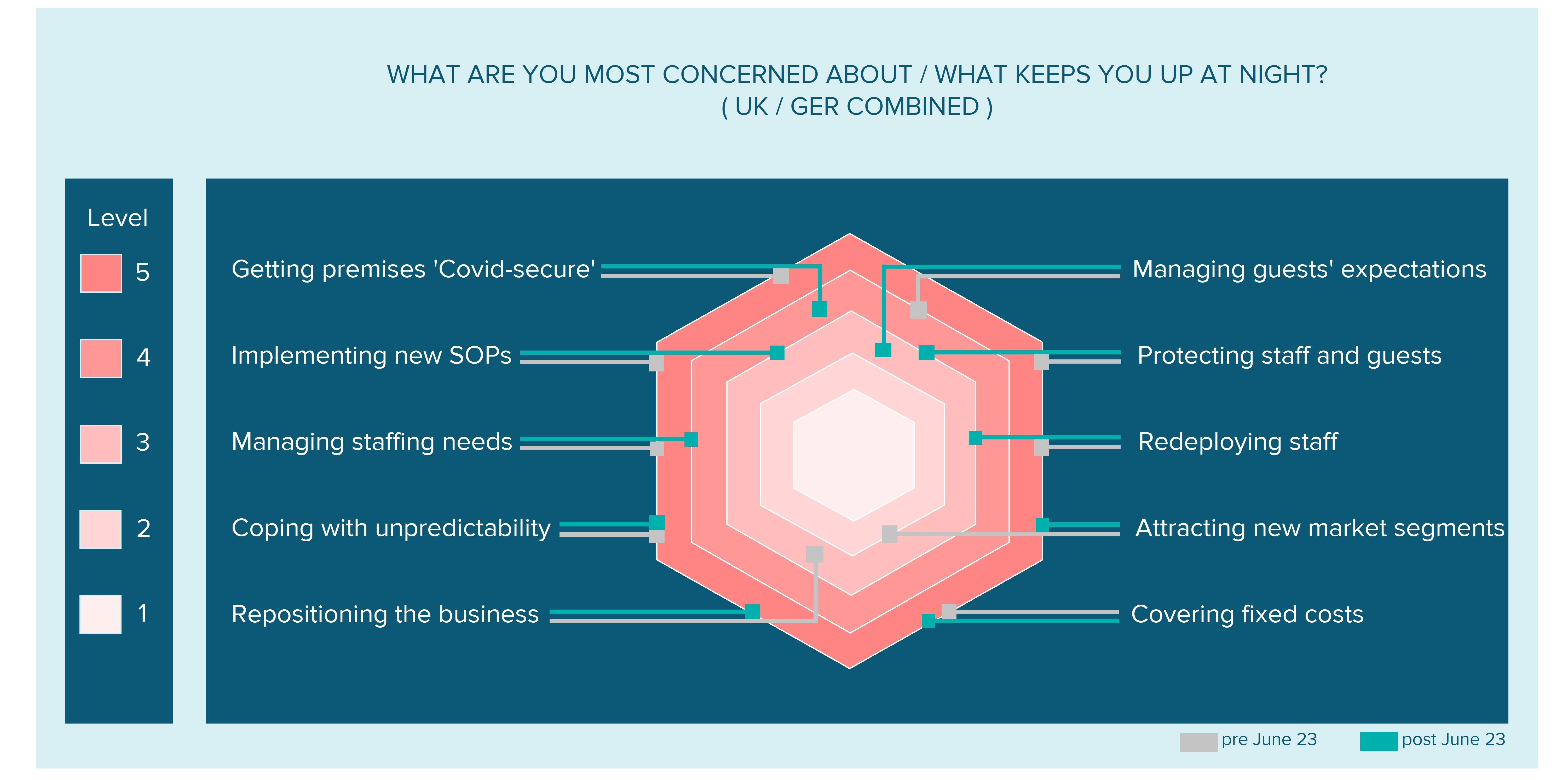

Going forward, plenty of worries remain which keep hotel executives up at night. It is interesting to observe that as businesses (prepare to) reopen and are accustomed to the ‘new normal’, the tactical and more operational issues – although still a worry – are seemingly becoming less of a concern. Most companies, whether or not they are already up-and-running, appear to have a good, or at least better, handle on managing the mitigating factors, such as training staff on health and safety measures, implementing new procedures for front- and back-of-house staff and enforcing new behaviours of social distancing. The bigger worries, both in the UK and Germany, relate to the mid- to long-term strategies around building and stabilising the businesses – in other words, working on business plans to reposition operations or, for example, attracting a different (more local) clientele.

More positively, it is encouraging to observe that, although battered by the crisis and its consequences, hoteliers were able to see silver linings. Keen to rebuild stronger and better, they seem to identify the disruption as a potential vehicle for positive change. The following three themes were amongst the most common ones:

- A chance to drive innovation, best practices and productivity by being required to reskill a large proportion of the workforce, to more closely collaborate, to decentralise decision-making to the ‘front line’ and to take bigger risks;

- A chance to strengthen the company’s talent pool and fast track potential future leaders of the industry as, with a significantly reduced workforce, most organisations are forced to push those who remain within their employ to more quickly ‘step up’ and prove themselves;

- A chance to reinvigorate the company culture but also to ‘level the playing field’ by having to (a) draw on a much wider and more diverse talent pool, (b) break down barriers between staff and senior management, and (c) accept greater workplace flexibility – all this is hoped to lead to greater empowerment, more evidenced-based decision making and more equality amongst staff.