Whitbread Tops 2012 European Hotel Board Study

The financial crisis, and the ensuing economic downturn, has illustrated the impact the business world can have on the daily lives of ordinary people. Whether it be a bank going under or Hostess Brands going bust and depriving the world of Twinkies, the man in the street is feeling the pain. It is human nature to want to understand why something goes wrong more than to comprehend why something goes right. The media helps feed this desire by ignoring the positive good that entrepreneurism and corporate growth does for our society, preferring to focus on exposing instances of foul play, corruption, and corporate greed. In today’s high tech age where transparency is such a high valued commodity and where information can be distributed so quickly, the business world is finding itself under the level of scrutiny once reserved for the political world.

Politicians are familiar with the expectations placed on them by the voting public in terms of moral standing and ethical practices. And, if they were not already, then cases such as the British MP expenses scandal or the sexual goings-on at the top of the French political establishment, have made them aware that there is no place to hide. There is also a demand placed on politicians to be ‘relevant’, to be ‘in touch’ with the people. Leaders of publicly listed companies are today facing a similar examination that does not stop at business affairs but also probes into personal lives. A CEO of a public company can expect to find himself/herself in the papers, and subsequently be forced to resign for any number of issues: sexual orientation, exposure of an affair with an employee, ‘excessive’ bonus, illness.

Shareholder discontent has a stronger voice than in the past, especially on contentious topics such as executive pay, and companies are having to demonstrate that its leadership, its governance, is ‘in touch’. The board of directors of a listed company is intended in part to act as the check and balance to what the people running the company day-to-day are doing. The spotlight therefore falls not only on the executives of a company but also on the non-executive directors and the last 10 years of improving corporate governance practice have seen a hefty increase in the responsibility and accountability borne by board members. The traditional image of a boardroom resembling a fusty old boy’s club is thankfully fading fast but how ‘in touch’ with modern society have boards become?

The European Hotel Board of Directors Study

The European Hotel Board of Directors study reviews the performance of boards at publicly quoted hotel companies in Europe. Applying a proprietary corporate governance model, we review board makeup, independence, committee structure, effectiveness, conflicts of interest, and executive and non-executive pay and reward. This year we have evaluated additional criteria concerning the actual individuals holding board seats. In particular we assessed the representation of women on boards, a topical issue across all industry sectors, and also looked at the demographics of board members with an emphasis on non-executives and whether or not they hold a current executive post elsewhere.

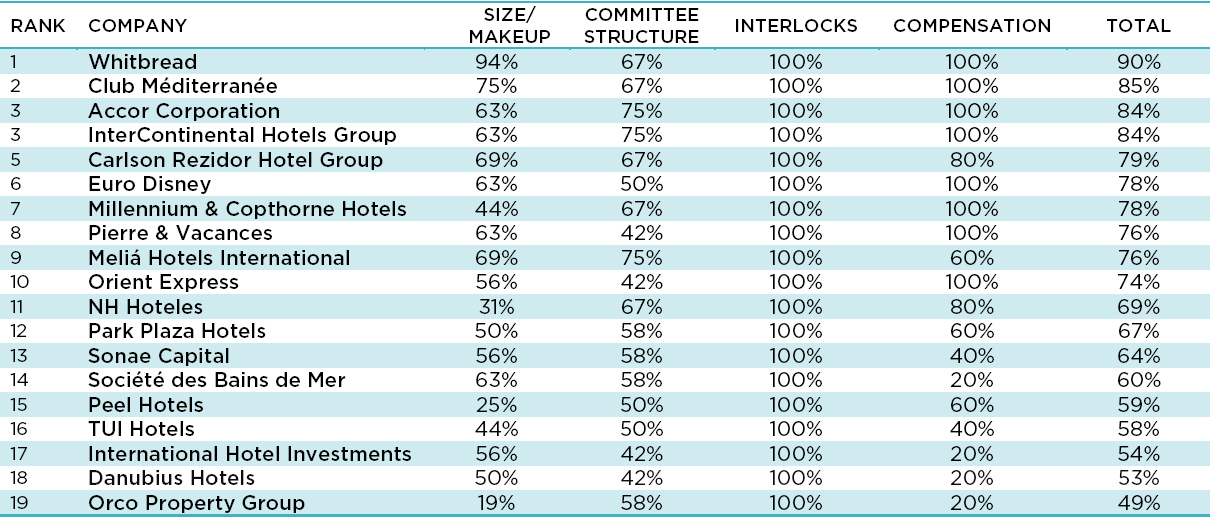

The top European Hotel Board in this year’s study is Whitbread, regaining its 2009 position at the top of the charts. The annual study also finds that Club Med has made great strides to improve its ranking from 5th to 2nd while last year’s winner, InterContinental Hotels Group slid to joint third alongside Accor. We raise a glass (rather, a cup of Costa Coffee) to Whitbread on leading the way among European hotel companies in the ways of corporate governance. We also applaud the French companies Accor, Club Med, Euro Disney and Pierre et Vacances as it is the first year in our study that all four have made it into the top ten, an indication of some significant improvements occurring.

Size & Makeup

In this year’s study there was a slight increase in the number of boards with an even number of directors from which one might surmise that boards are having a harder time making decisions with no clear cut majority when voting. A board with an ideal size and makeup is one with:

- An odd number of between 5 and 11 directors;

- An independent outsider as Chairman;

- A majority of independent directors.

In Europe, Whitbread was the only company to achieve full marks in this respect with 11 board members, separate CEO and Chairman, a Chairman who is an outsider and 8 independent directors versus 3 insiders.

The Non-Executive Director

New for this year’s study we examined how many of non-executive directors are in full-time executive employment elsewhere. The boardrooms of yore full of white haired retired men have lost their relevance. While there are benefits of a retired non-executive – easier to make the time commitment, typically a treasure trove of previous experience and wisdom – shareholders are now demanding more. They want their board directors to prove they are qualified to provide the counsel and level of support that is expected of them. To do this well it is highly beneficial if these individuals are presently in a senior leadership role in another business where they are dealing with similar challenges and opportunities on a daily basis. The experiences gained there can lend the non-executive director useful perspective when tackling issues facing the board. Our study found that half of all non-executives currently occupy a full-time executive post, such as CEO, somewhere else. We view this as encouraging and would like to see an increase in the coming years coupled with a further overall reduction in the average length of term that a board member serves.

Women on Boards

The issue of female board membership has been hotly debated – both in business and in politics – for a majority of the last decade. The European Union, and in particular the European Commissioner for Justice Viviane Reding, has been trying to boost the number of women in business through numerous guidelines and recommendations, albeit with limited degree of success.

The number of women holding board positions in Europe is currently at a meager 13.7%1. In order to raise this to a more substantial figure within the next few years, discussions have arisen to implement mandatory quotas. It has been suggested, for example, to mandate listed companies in Europe to reserve 40% of their non-executive board seats for women (a figure at which companies should gradually arrive to by 2020). The policy would likely affect only those companies with annual revenues in excess of EUR €50 million and more than 250 employees.

Countries such as France, Italy, Spain and the Netherlands have volunteered to implement national quotas, but countries like the UK and Sweden have raised strong concerns about such measures. They argue that quotas would limit the freedom of a company, the board and its shareholders to run the business in the best interest of those involved.

While debates continue over the rights and wrongs of quotas versus having the best person in the job irrespective of gender, few dispute the central argument that boardrooms are heavily male dominated. Good news from the study is that there are more women on hotel company boards in Europe today than was previously the case. In 2011, the average number of women on the board of a publicly traded hotel company in Europe increased by 32% over 2010. That said, women still only account for 15% of board seats so there is still some way to go before the recommended one-third threshold that many are lobbying for is achieved.

Carlson Rezidor Hotel Group was the standout with 30% of its board directors being female. Other above average performers in this category included Accor, IHG, Club Med and Whitbread; each with more than one-fourth of their board seats being occupied by women. Worryingly however, almost one-third of the companies surveyed had no women on their boards at all.

Committees

Audit, Remuneration and Nomination committees are crucial to sound corporate governance. It is a relief to note that insider participation on subcommittees has greatly reduced. Of the three, the Audit committees met most often during the year as is usual. Interestingly, the Nomination Committee met on fewer occasions than in the previous year leading one to surmise that there was less movement and therefore fewer appointments at the board and/or CEO level.

Pay-for-Performance

This is, typically, the headline grabbing category. The one which the public pays particular attention to; all the more so in tough economic times when your average Joe is struggling to make ends meet. When assessing the competiveness and appropriateness of an executive pay plan, we looked at:

- the weighting of fixed to variable compensation;

- benefits;

- structure of the long-term incentive plan.

Scenarios which concern us include, for example, where a CEO’s compensation is greater than the total combined compensation of the rest of the executive team; or where the base salary is above average and yet the bonus award or potential is below market average; or where allowances and benefits are excessive.

Non-executive board pay is preferably a combination of board fee, committee fees and shares, or some other form of ownership (which does not include stock options). It tends to be the larger multi-national companies which excel in this arena and those receiving top marks this year included Accor, Club Med, Euro Disney, IHG, Millennium & Copthorne, Pierre et Vacances, Orient Express, and Whitbread.

Please contact the authors for any further information on this study including the allocation of points.